Trends in Liquid Packaging Board Market 2025-2035

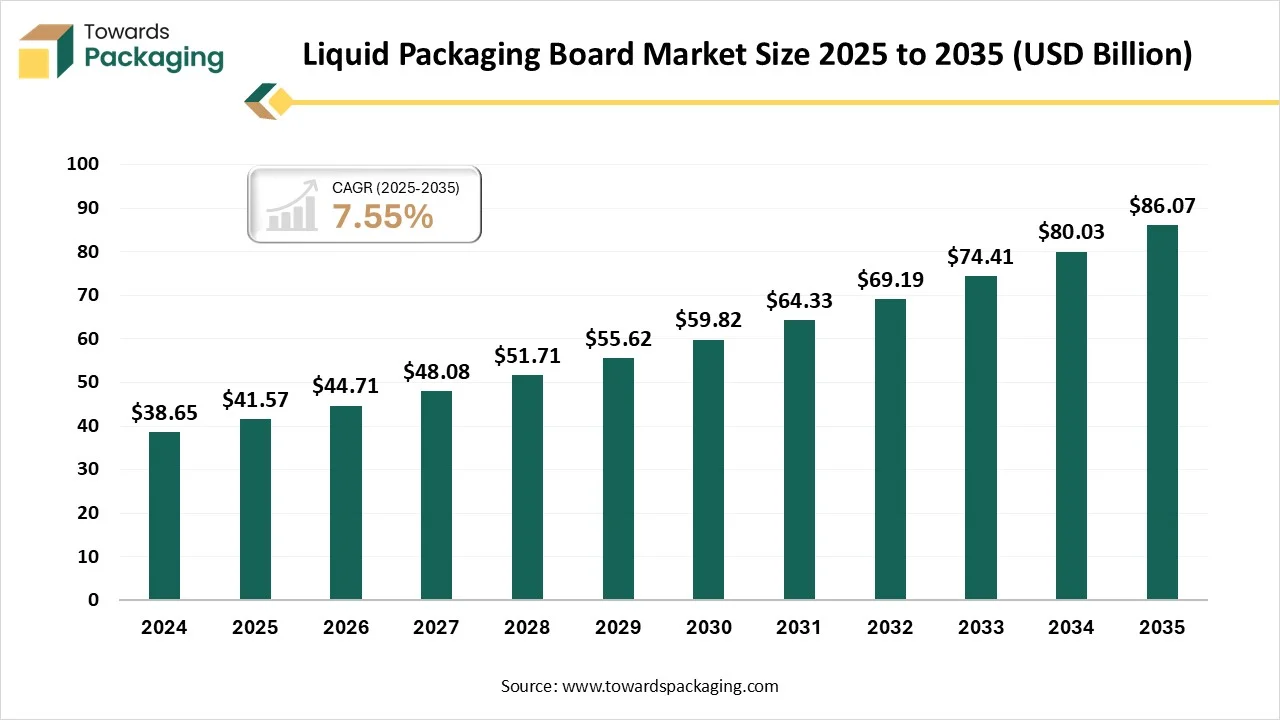

According to a recent analysis by Towards Packaging, the global liquid packaging board market is projected to expand from USD 44.71 billion in 2026 to USD 86.07 billion by 2034, recording a CAGR of 7.55% between 2025 and 2034.

Ottawa, Dec. 05, 2025 (GLOBE NEWSWIRE) -- The global liquid packaging board market reached approximately USD 41.57 billion in 2025, with projections suggesting it will climb to USD 86.07 billion in 2034, according to a report from Towards Packaging, a sister firm of Precedence Research. This market is growing due to rising demand for safe, sustainable, and recyclable packaging solutions for beverages and liquid food products.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

Key Insights

- Europe dominated the liquid packaging board market, having the biggest share in 2024.

- Asia Pacific is expected to rise at a notable CAGR between 2025 and 2034.

- By grade, the solid bleached sulfate board segment has contributed the largest market share in 2024.

- By grade, the coated unbleached kraft board segment will grow at a notable CAGR between 2025 and 2034.

- By packaging type, the cartons segment contributed the largest share in 2024.

- By packaging type, the pouches segment will grow at a notable CAGR between 2025 and 2034.

- By application, the dairy products segment contributed the largest share in 2024.

- By application, the juices & beverages segment will grow at a notable CAGR between 2025 and 2034.

Key Technological Shifts

- Barrier Coating Innovations: For increased recyclability and food safety, switch from aluminum and plastic layers to bio-based and water-borne coatings.

- Light-weighting Technologies: Development of high-strength, low-weight fiber structures to reduce material usage and transportation costs.

- Digital Printing & Smart Packaging: Adoption of track and trace labels, QR codes, and superior digital printing for supply chain visibility, branding, and authenticity.

- Renewable material Integration: Increased use of plant-based polymers and recycled fiber to lower carbon footprint and improve sustainability claims.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5884

What is Liquid Packaging Board?

The liquid packaging board market is expanding as beverage, dairy, and liquid food brands increasingly shift toward recyclable fiber-based packaging solutions. Rising consumer awareness of sustainability is pushing manufacturers to replace plastic with renewable, low-carbon paperboard alternatives. Furthermore, new developments in lightweight board structures and barrier coatings are improving product safety performance and shelf life, hastening adoption in international markets.

Private Industry Investments in Liquid Packaging Board:

- Suzano's acquisition of Pactiv Evergreen facilities: Suzano acquired two US industrial facilities from Pactiv Evergreen for $110 million, adding approximately 420,000 metric tonnes of annual paperboard capacity to become a major North American supplier for liquid packaging board production.

- Stora Enso's Skoghall Mill expansion: Stora Enso invested around $112.56 million in the expansion of its Skoghall Mill, which increased packaging board production capacity by approximately 100,000 tonnes per annum (TPA) to exceed 900,000 TPA.

- JK Paper's new packaging board plant: JK Paper invested approximately INR 14.5 billion (~USD 195.3 million) to construct a new packaging board facility in Gujarat, which added 200,000 TPA of capacity to its overall production.

- N R Agarwal Industries' new multilayer board plant: N R Agarwal Industries committed INR 1,200 crore to establish a new 1000 TPD (tonnes per day) multilayer board plant (Unit VI), reinforcing its capacity expansion and core operations.

-

Elopak and GLS joint venture: Elopak and GLS formed a joint venture to manufacture and process high-quality aseptic packaging solutions, designed to ensure liquid food is safe and accessible to consumers globally.

Key Trends

| Trends | What's Happening | Why it matters |

| Eco-friendly Materials | Shift from plastic to bio-based, recyclable boards | Meets regulations + strong consumer demand for green packs |

| Premium Packaging | Brands using high-impact print & designs | Boosts shelf appeal and brand loyalty |

| Aseptic Growth | Surge in long shelf-life liquid cartons | Enables safe storage without preservatives |

| New Applications | Adoption in plant-based drinks & liquid foods | Expands market beyond dairy & juice |

| Circular Recycling Models | Focus on fiber recovery & closed loops | Cuts waste, improves sustainability metrics |

Market Opportunities

| Opportunity | What It Means | Why it’s Attractive |

| Sustainable Packaging Demand | Supply eco-friendly, recyclable cartons to replace plastic | Strong consumer pull + regulatory push |

| Plant-based & Functional Drinks Growth | Packaging for dairy alternatives, juices, and nutrition drinks | Fast-growing category with high volumes |

| Aseptic Carton Expansion | Provide a long shelf-life, preservative-free solution | Ideal for emerging markets and export products |

| Premium Branding & Customization | Offer high-end prints, shapes, and smart packaging | High margins and brand differentiation |

| Recycling Infrastructure Development | Lead in fiber recovery and closed-loop systems | Builds long-term competitiveness + ESG value |

| Light-weighting Innovations | Develop high-strength, low-weight boards | Reduces costs, improves sustainability footprint |

More Insights of Towards Packaging:

- Heat Sealable Packaging Market Key Trends, Innovations & Market Dynamics

- Sustainable Secondary Packaging Market Trends, Investment Opportunities & Competitive Benchmarking

- Agricultural Films and Bonding Market Intelligence Report, Key Trends, Innovations & Market Dynamics

- Hazardous Label Market Performance, Trends and Strategic Recommendations

- Isothermal Packaging Market Research Insight: Industry Insights, Trends and Forecast

- Consumer Packaging Market Insights, Forecast and Competitive Strategies

- Single Dose Packaging Market Intelligence Report, Key Trends, Innovations & Market Dynamics

- Biodegradable Plastic Films Market Strategic Growth, Innovation & Investment Trends

- Packaging Wax Market Size, Value Chain & Trade Analysis 2025-2034

- Chemical Packaging Material Market Insights, Forecast and Competitive Strategies

- Pre-press for Packaging Market Investment Opportunities & Competitive Benchmarking

- Horizontal Form-Fill-Seal (HFFS) Pouching Machines Market Size, Trends, Segments, Regional Insights, Competitive Landscape & Trade Analysis

- Horizontal Form-Fill-Seal (HFFS) Pouching Machines Market Size, Trends, Segments, Regional Insights, Competitive Landscape & Trade Analysis

- Aseptic Packaging for Non-Carbonated Beverages Market Size, Share, Trends and Forecast 2024-2035

- Punnet Packaging Market Growth Drivers, Challenges and Opportunities

- End-of-Line Packaging Market Size, Share, Growth Analysis, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), and Competitive Landscape 2024-2035

-

Sealing and Strapping Packaging Tapes Market Size, Segments and Regional Data (NA/EU/APAC/LA/MEA) 2025-2034

Segmental Insights

By Grade

The solid bleached sulfate board (SBS) segment dominates the market because of its premium printability, high stiffness, and strong barrier properties, making it ideal for high-quality liquid packaging applications. It is widely used by beverage and dairy brands seeking strong shelf appeal and product safety. Its leadership in food-grade packaging is further reinforced by its capacity to accommodate advanced sealing and multilayer coating.

Coated unbleached kraft board (CUK) is the fastest-growing grade due to its strength, recyclability, and sustainable profile. It is increasingly adopted by brands targeting eco-friendly packaging solutions without compromising mechanical performance. CUK is becoming more popular as a lower-carbon substitute for completely bleached boards as sustainability regulations become more stringent.

By Packaging Type

Cartons dominate the liquid packaging board market because they provide lightweight, durable, and cost-efficient protection for milk, juices, and beverages. Their recyclability, shelf-life extension, and branding opportunities make them a preferred format for mass market and premium beverages. Strong adoption is supermarkets and e-commerce support continued dominance.

Pouches are the fastest-growing packaging type, driven by demand for portable, flexible, and lower material-use packaging. They offer convenience and improved sustainability performance because of reduced weight and transport emissions. Pouch usage is quickly increasing across all beverage categories as companies focus on single-serve and on-the-go consumption.

By Application

Dairy products dominate the liquid packaging board market due to high consumption of milk, flavored milk, and dairy-based drinks requiring safe and sterile packaging. Cartons and board-based formats help extend shelf life and maintain nutritional quality. Dominance in this category is further ensured by large production volumes and robust retail penetration.

Juices & beverages are the fastest-growing application as consumers shift toward healthier drinks, functional beverages, and plant-based alternatives. Advanced board solutions are in high demand due to packaging innovation that focuses on sustainability, premium aesthetics, and shelf-life enhancement. Growth in ready-to-drink formats is accelerating adoption in this segment.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

By Region

Europe dominates the market due to strict laws that encourage recycling, strict packaging requirements, and the widespread use of sustainable materials. The region's beverage companies are among the first to use environmentally friendly carton solutions. A mature dairy and beverage sector also drives consistent demand for high-performance boards.

Germany Liquid Packaging Board Market Trends

Germany supports Europe's dominance with robust recycling systems, stringent sustainability laws, and an established dairy and beverage sector. High adoption of recyclable cartons and premium packaging formats drives steady demand.

Asia Pacific is the fastest-growing region, driven by growing beverage consumption, fast urbanization, and the dairy processing sector. The demand for liquid packaging boards is rising due to both modern retail growth and increased investment in packaging infrastructure. Sustainability awareness is also rising, supporting the adoption of recyclable board solutions.

India Liquid Packaging Board Market Trends

India leads in the liquid packaging board market because of the growth of dairy processing, the transition from loose milk to packaged formats, and the increase in the consumption of packaged beverages. Investments in modern packaging and sustainability trends are boosting carton demand. Rapid urbanization and retail penetration are accelerating the adoption of branded packaged beverages. Affordability and market availability are improving as a result of global players increasing their local manufacturing.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Recent Developments in the Liquid Packaging Board Industry

- In July 2025, SIG launched the world's first aseptic 1-liter carton pack with full barrier protection and no aluminum layer. The innovation offers a shelf life of up to 12 months and reduces environmental impact by eliminating aluminum.

- In July 2025, Tetra Pak announced expansion of its Vietnam Binh Duong plant with a second aseptic-carton line, boosting capacity to over 30 billion packs annually and strengthening its liquid packaging board supply across Southeast Asia and ANZ.

Top Companies in the Liquid Packaging Board Market & Their Offerings:

- Tetra Pak International S.A.: A leading global provider of food processing and packaging solutions, focusing on aseptic technology.

- SIG Combibloc Group: A major player in aseptic carton packaging, betting big on sustainability and growing markets like India.

- Stora Enso: A Finnish company focused on renewable materials, producing high-barrier liquid packaging board.

- International Paper: A large pulp and paper company offering a wide range of products, including reliable liquid packaging board.

- Smurfit Kappa: Innovates with fully recyclable and biodegradable packaging, offering solutions like bag-in-box with recyclable film.

- Elopak AS: Provides advanced aseptic packaging solutions, recognized for its focus on sustainability and joint ventures.

- Amcor: A global leader in sustainable and innovative packaging solutions.

- Mondi Group: Offers a broad portfolio of packaging solutions and is highly focused on sustainability.

- WestRock: Combines innovation and sustainability, producing coated liquid packaging boards.

- Greatview Aseptic Packaging: Known for cost-effective aseptic liquid packaging, with a significant presence in high-growth markets.

Segments Covered in the Report

By Grade

- Coated Unbleached Kraft Board (CUK)

- Solid Bleached Sulfate Board (SBS)

- Uncoated Kraft Board

By Packaging Type

- Cartons

- Pouches

- Cups

- Cans

- Others (Trays, Bottles)

By Application

- Dairy Products

- Juices & Beverages

- Liquid Food (Soups, Sauces, etc.)

- Alcoholic Beverages

- Others (Pharmaceutical, Household Liquids)

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5884

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Towards Packaging Releases Its Latest Insight - Check It Out:

- PET Blow Molder Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- U.S. Beverage Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Plastic Caps Market Size USD 67.66 Billion by 2034, Global Trends, Segment Insights, Regional Outlook, Competitive Landscape and Value Chain Analysis

- Agriculture Chemical Packaging Market Size, Trends, Segments, Regional Outlook (NA, EU, APAC, LAMEA), Companies & Competitive Analysis 2025-2034

- Europe End-of-Line Packaging Market Size, Share, Trends, Segments, and Forecast 2025-2034

- North America Corrugated and Folding Carton Packaging Market Size, Trends, and Competitive Analysis 2025-2034

- North America Corrugated Packaging Market Size, Trends, Segments, Companies Profile, Competitive & Value Chain Analysis 2025-2034

- Ergonomic Packaging Market Size, Trends, Segments, Regional Analysis & Competitive Landscape 2025-2034

- Sharps Container Market Size, Trends, Segmentation, Regional Insights, and Competitive Landscape Analysis 2025-2034

- Luxury Rigid Box Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Airless Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Generative AI in Packaging Market Size, Trends, Segmentation, Regional Outlook (NA, EU, APAC, LA, MEA) and Competitive Analysis 2025-2034

- Metallized Film Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Liquid Packaging Board Market Size, Trends, Segmentation, Regional Outlook, Trade Dynamics & Competitive Landscape Report (2025-2035)

-

Automatic Labeling Machine Market Size, Trends, Segmentation, Regional Outlook (NA, EU, APAC, LA, MEA), Value Chain & Competitive Landscape Report (2025-2035)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.